My friend Ann said, “What I want to know is: What is stopping me from investing my money?”

Ann is not alone. A Nationwide Financial survey found that more people are afraid of investing in the stock market (62%), than are afraid of death (58%), or public speaking (57%.)

Daniel Kahneman, psychologist and winner of the Nobel Prize in Economics, gave advice on this topic in his book Thinking, Fast and Slow. Kahneman gave this sermon to fictional character Sam:

“I sympathize with your aversion to losing any gamble, but it is costing you a lot of money.”

Kahneman advised, “You will do yourself a large financial favor if you are able to see each of these gambles as part of a bundle of small gambles and rehearse the mantra that will get you significantly closer to economic rationality: you win a few, you lose a few. The main purpose of the mantra is to control your emotional response when you do lose.”

The author did not condone reckless gambling. He had three limits on his “win a few, lose a few mantra.”

- Diversify. The gambles have to be independent of each other. “…it does not apply to multiple investments in the same industry, which would all go bad together.”

- Don’t bet the farm. The gamble should be small enough so you are not worried about a significant loss to your wealth. “If you would take the loss as significant bad news about your economic future, watch it!”

- No long shots. This mantra doesn’t apply to long shots which he described as “the probability of winning is very small for each bet.”

Kahneman said you have to have emotional discipline to follow the above rules. But his main point is that you should see each decision as one of many small decisions in a portfolio. Emotional distress can also be reduced by cutting back on how often you check how your investments are doing.

Related Blog Posts

“How to Handle Emotions When Making Investment Decisions”

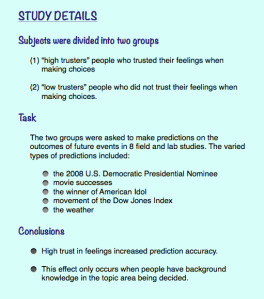

“When to Trust Your Intuition or Gut Instinct When Making Financial Decisions”

“How the Heck Do I Invest my Money?”

Sources

“Nationwide Financial Survey Finds Fear of the Markets Trumps Fear of Death”

“Thinking, Fast and Slow” by Daniel Kahneman, pages 338-339